cryptocurrency tax calculator ireland

Capital gains tax CGT form. The relevant legislation and case law.

Best Crypto Tax Software To Use For 2022 Tax Season

See Taxation of crypto-asset transactions for guidance on the tax treatment of various transactions involving cryptocurrencies and crypto-assets.

. The direct taxes are corporation tax income tax and capital gains tax. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant. To use this crypto tax calculator input your taxable income for 2021 before considering any crypto gains and your 2021 tax filing status.

Capital gains tax. For further information please click the link. This means you may owe taxes if your coins have increased in value whether youre using them as an investment or like you would cash.

He had bought them for 4500. You can discuss tax scenarios with your accountant. Anyway on a more practical level as an investor in cryptocurrency the tax you need to worry about is capital gains tax which is levied on crystallised gains of more than.

Bitcointax is the leading capital gains and income tax calculator for Bitcoin Ethereum Ripple and other digital currencies. Download your tax reports. Ireland has its own cryptocurrency called Irishcoin.

The deadline for filing CGT is at the end of this month. Coinpanda generates ready-to-file forms based on your trading activity in less than 20. Take the initial investment amount lets assume it is 1000.

Enter the price for which you purchased your crypto and the price at which you sold your crypto. Heres an example of how to calculate the cost basis of your cryptocurrency. Be sure to add how long youve owned the cryptocurrency.

Therefore individuals that are trading in cryptocurrency are required to file an income tax return Form 11 or Form 12 each year and declare profits made on trading. Bitcoin Taxes has provided services to consumers and tax professionals since its launch in 2014. The profits will be subject to normal income tax rules ie.

6 The law requires that VASPs who exchange fiat currencies for cryptocurrencies must adhere to know-your-customer. The profits will be subject to normal income tax. Take the initial investment amount lets assume it is 1000.

In other words if youre making profits or losses through the disposal of your cryptocurrency whether by selling gifting or exchanging you need to pay a 33 Capital Gains Tax CGT. Generate ready-to-file tax forms including tax reports for Forks Mining Staking. The direct taxes are corporation tax income tax and capital gains tax.

If you dont want to use a tax calculator for whatever reason you have. The standard capital gains tax of 33 applies to crypto as well if you are an individual and not a corporation the first 1270 of capital gains are exempt. Direct tax treatment of cryptocurrencies.

17 May 2022 Please rate how useful this page was to you Print this page. You simply import all your transaction history and export your report. Irish citizens have to report their capital gains from cryptocurrencies.

PRSI PAYE and USC Will apply at the. The simple answer is yes. The deadline for filing CGT is at the end of this month.

The resulting number is your cost basis 10000 1000 10. In Ireland cryptocurrency investments are subject to the same regulations as investments in stocks and shares. Tax-Loss Harvesting With A Crypto Tax Calculator In general terms losses resulting from cryptocurrency trades are tallied against any gains made in the current year.

Direct tax treatment of cryptocurrencies. You bought 1000 worth of Bitcoin and sold it for 3000 later on. In Revenues most recent guidance material outlining how cryptocurrencies transactions should be treated for Irish tax purposes they formed the view that no special tax rules are required.

Cryptocurrency transactions are subject to both Income Tax and Capital Gains Taxes in Ireland as well as to Capital Acquisitions Tax or Gift Tax. Using FIFO and the 4 weeks rule. Disposal is a tax term and is generally one of two things.

However this exemption amount includes capital gains and losses as a whole you have made throughout the year in a variety of asset classes not just crypto. Recently Ireland passed a law that requires cryptocurrency companies called virtual asset service providers VASPs to register with the Central Bank of Ireland and comply with the EUs anti-money laundering guidelines. If you are tax resident in Ireland then you need to pay Capital Gains Tax CGT of 33 on any profit you make on the disposal of a cryptocurrency.

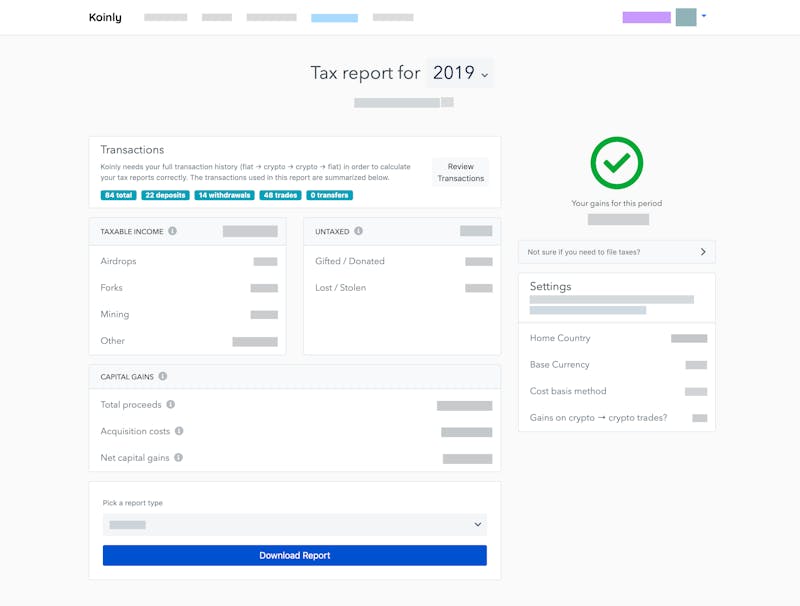

With the standard CGT rate of 33 the amount of tax you will have to pay will be 730. That is the profits from trading will be taxable under Income Tax rules. Koinly helps you calculate your capital gains for both periods in accordance with Revenue Commissionerss guidelines ie.

Your chargeable gain is therefore 3000 - 1000 2000. In Ireland crypto investments are treated just like investments in stocks or shares. Cryptocurrencies and crypto-assets.

As with any other activity the treatment of income received from charges made in connection with activities involving cryptocurrencies will depend on the activities and the parties involved. This means that profits from crypto transactions are subject to capital gains tax at. As with any other activity the treatment of income received from charges made in connection with activities involving cryptocurrencies will depend on the activities and the parties involved.

Coinpanda lets Irish citizens calculate their capital gains with ease. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. Use our crypto tax calculator below to determine how much.

There are no special tax rules for cryptocurrencies or crypto-assets. If you are an Irish citizen you will need to file your capital gains from crypto trading on a Capital Gains Tax form for both the Initial and Later periods. Cryptocurrency Tax Calculator For Ireland Revenue Commissioners Koinly Crypto Tax Calculator Doing Your Crypto Taxes Has Never Been Easier Boinnex Cryptocurrency Taxes In Australia 2021 2022 Guide Cointracker 3 Steps To Calculate Binance.

Tax and Duty Manual Part 02-01-03 5 131 Example 1 John sold crypto-assets for 5000 in 2021. Revenue has set out guidelines on how cryptocurrency buying trading and mining is taxed. This guide breaks down everything you need to know about crypto taxes.

Irish citizens have to report their capital gains from cryptocurrencies. You sell the cryptocurrency for cash. Cryptocurrency Tax Calculator Alternatives.

Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins. You then deduct your personal exemption to find your taxable gain which is 2000 - 1270 730. If youre looking for a way to track your.

Capital gains tax report. The nature of asset changes.

Cryptocurrency Tax Calculator For Ireland Revenue Commissioners Koinly

Ireland Cryptocurrency Tax Guide 2021 Koinly

Crypto Tax Calculator Doing Your Crypto Taxes Has Never Been Easier Boinnex

Koinly Vs Coinledger Io Ex Cryptotrader Tax Which Tax Calculator Is Better Captainaltcoin

Ireland Cryptocurrency Tax Guide 2021 Koinly

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

Cryptocurrency Tax Calculator For Ireland Revenue Commissioners Koinly

Cryptocurrency Tax Guides Help Koinly

Ireland Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Koinly Vs Coinledger Io Ex Cryptotrader Tax Which Tax Calculator Is Better Captainaltcoin

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

Find The Best Crypto Tax Software For Reporting Your 2021 Taxes

How To Calculate Crypto Taxes Koinly

Crypto Tax Calculator Review And Best Alternatives Crypto Listy

Crypto Tax Calculator Cryptocurrency And Nft Tax Software Review

Koinly Vs Zenledger 2022 Is Zenledger Better Than Koinly

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill